Comparing currency trading strategies¶

In this example, we compare two strategies for trading currencies that differ only in the degree of the underlying model. We present an example in which the higher degree model outperforms the lower degree model.

We start by loading the necessary modules and functions.

In [1]:

%matplotlib inline

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

import numpy as np

import pandas as pd

import os, fem, time

data_dir = '../../../data/currency'

cache = True

print 'number of processors: %i' % (fem.fortran_module.fortran_module.num_threads(),)

number of processors: 32

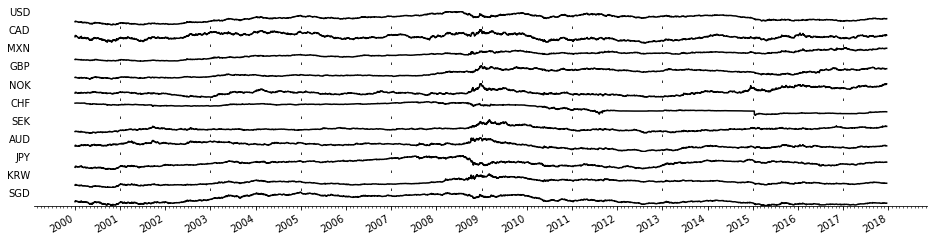

We use data of the currency exchange rates relative to the Euro from 2000 to 2018 for \(n=11\) currencies (USD, CAD, MXN, GBP, NOK, CHF, SEK, AUD, JPY, KRW, and SGD) plotted below.

In [2]:

# load data

currency = pd.read_csv(os.path.join(data_dir, 'currency.csv'), index_col=0)

x = currency.values.T

# plot data

fig, ax = plt.subplots(x.shape[0], 1, figsize=(16,4))

date2num = mdates.strpdate2num(fmt='%Y-%m-%d')

dates = [date2num(date) for date in currency.index]

for i, xi in enumerate(x):

ax[i].plot_date(dates, xi, 'k-')

ax[i].set_ylabel(currency.columns[i], rotation=0, ha='right')

ax[i].set_yticks([])

for i in range(x.shape[0]-1):

for spine in ['left', 'right', 'top', 'bottom']:

ax[i].spines[spine].set_visible(False)

for spine in ['left', 'right', 'top']:

ax[-1].spines[spine].set_visible(False)

ax[-1].xaxis.set_major_locator(mdates.YearLocator())

ax[-1].xaxis.set_major_formatter(mdates.DateFormatter('%Y'))

ax[-1].xaxis.set_minor_locator(mdates.MonthLocator())

fig.autofmt_xdate()

plt.show()

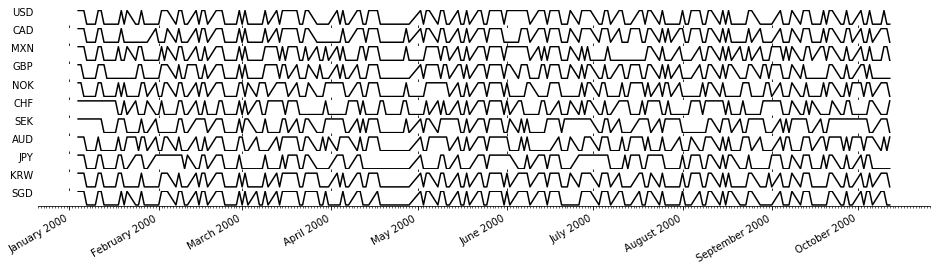

We discretize each currency exchange rate sequence \(\{x_i(t)\}_{t=t_1}^{t_{\ell}}\), where \(\Delta t=t_{k+1}-t_k=1\) day, by recording the sign of the daily movement \(\{s_i(t))\}_{t=t_2}^{t_{\ell}}\) with stagnation settled by the sign of the mean change:

The first 200 fluctuations for each currency are plotted below.

In [3]:

# daily movement

dx = np.diff(x, axis=1)

# sign of daily movement

s = np.sign(dx).astype(int)

for i, si in enumerate(s):

s[i][si==0] = np.sign(dx[i].mean())

fig, ax = plt.subplots(s.shape[0], 1, figsize=(16,4))

for i, si in enumerate(s):

ax[i].plot_date(dates[1:201], si[:200], 'k-')

ax[i].set_ylabel(currency.columns[i], rotation=0, ha='right')

ax[i].set_yticks([])

for i in range(s.shape[0]-1):

for spine in ['left', 'right', 'top', 'bottom']:

ax[i].spines[spine].set_visible(False)

for spine in ['left', 'right', 'top']:

ax[-1].spines[spine].set_visible(False)

ax[-1].xaxis.set_major_locator(mdates.MonthLocator())

ax[-1].xaxis.set_major_formatter(mdates.DateFormatter('%B %Y'))

ax[-1].xaxis.set_minor_locator(mdates.DayLocator())

fig.autofmt_xdate()

plt.show()

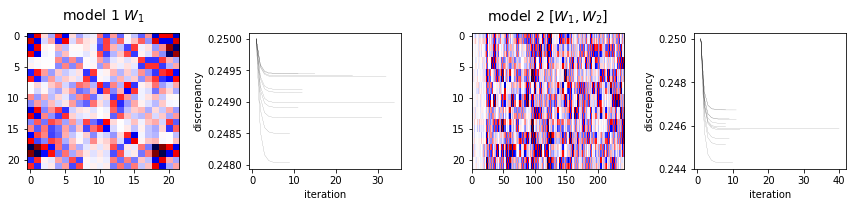

We fit two different models to the one-hot encodings of the binary data \(\{s_i(t)\}_{t=t_2}^{t_{\ell}}\). The one-hot encoding of \(s(t_k)=(s_1(t_k),\ldots,s_{n}(t_k))^T\in\{-1,1\}^n\) is a binary vector \(\sigma(t_k)=(\sigma_1(t_k),\ldots,\sigma_n(t_k))^T\in\{0,1\}^{2n}\) where \(\sigma_i(t_k)=(1,0)^T\) if \(s_i(t_k)=1\) and \(\sigma_i(t_k)=(0,1)^T\) if \(s_i(t_k)=-1\). In either model, the probability that \(x_i\) increases from \(t_k\) to \(t_{k+1}\) is assumed to be

The two models differ in their definition of \(h\); in the first model, \(h(\sigma(t_k)) = W_1\sigma(t_k)\), but in the second model, \(h(\sigma(t_k)) = W_1\sigma(t_k) + W_2\sigma^2(t_k)\). The quadratic term \(\sigma^2\) consists of distinct nonzero products of the form \(\sigma_{j_2}\sigma_{j_1}\), \(1\leq j_1, j_2\leq 2n\) (see FEM for discrete data for more information on degrees of \(\sigma\)).

For demonstration, we instantiate two models, one with degs=[1] and

one with degs=[1,2], and fit them to the whole currency data set. We

plot the heat maps of the fitted model parameters and the running

discrepancies during the fit for both models below.

In [4]:

# create two models

models = [fem.discrete.fit.model(degs=[1]), fem.discrete.fit.model(degs=[1, 2])]

# fit model to whole currency data set

for i, model in enumerate(models):

start = time.time()

model.fit(s[:,:-1], s[:, 1:], overfit=False)

end = time.time()

print 'model %i fit time: %.02f seconds' % (i+1, end-start)

# plot model parameter heat maps and running discrepancies

fig, ax = plt.subplots(1, 4, figsize=(12, 3))

for i, model in enumerate(models):

w = np.hstack(model.w.itervalues())

scale = np.abs(w).max()

ax[2*i].matshow(w, cmap='seismic', vmin=-scale, vmax=scale, aspect='auto')

ax[2*i].xaxis.set_ticks_position('bottom')

for d in model.d:

ax[2*i+1].plot(1 + np.arange(len(d)), d, 'k-', lw=0.1)

ax[2*i+1].set_xlabel('iteration')

ax[2*i+1].set_ylabel('discrepancy')

ax[0].set_title('model 1 $W_1$', fontsize=14)

ax[2].set_title('model 2 $[W_1, W_2]$', fontsize=14)

plt.tight_layout()

plt.show()

model 1 fit time: 0.13 seconds

model 2 fit time: 0.84 seconds

Next, we devise two simple trading strategies that train the models on a

moving time window then predict \(s\) one day ahead of the window.

We keep track of our account balances and prediction accuracies in the

acccount and accuracy variables. The trading strategies work as

follows. The models are trained on the data in the time window \([\)

t1 \(,\) t1 \(+\) tw \(-1]\) to predict

\(s(\) t1+tw \()\). Initially, t1 \(=\) t0, the

initial time of the data set, and t1 is incremented by 1 while

t1+tw is less than tn, the final time of the data set. On each

day, we pass the data at t1 \(+\) tw to model.predict,

which returns a prediction, 1 or -1, and probability greater than 0.5 of

the price movement tomorrow. We select to trade only those currencies

whose probabilities are greater than threshold, and we invest our

whole account value weighted in the chosen currencies according the

probabilities leveraged by a constant factor leverage. The models

are retrained every dt days.

In [5]:

account_file = os.path.join(data_dir, 'account.npy')

accuracy_file = os.path.join(data_dir, 'accuracy.npy')

if cache and os.path.exists(account_file) and os.path.exists(accuracy_file):

account = np.load(account_file)

accuracy = np.load(accuracy_file)

else:

# t0, tn: initial and final time

t0, tn = 0, s.shape[1]

# daily balance

account = np.ones((2, tn))

# daily prediction accuracy

accuracy = np.zeros((2, tn))

# tw: training time window width

# dt: retraining period

tw, dt = 200, 1

# t1, t2: limits of moving training window

t1, t2 = t0, t0+tw

# maximum position weight

max_weight = 1.0 / 3.0

# trade if probability above threshold

threshold = 0.75

# percentage of account to bid

leverage = 1.0

start = time.time()

while t2 < tn:

# todays price

price = x[:, t2]

# tomorrows change

realized_s = s[:, t2]

realized_dx = dx[:, t2]

percent_change = realized_dx / price

for i, model in enumerate(models):

# start todays account with yesterdays balance

account[i, t2] = account[i, t2-1]

# retrain the model

if not (t1-t0) % dt:

s_train = s[:,t1:t2]

model.fit(s_train[:,:-1], s_train[:, 1:], overfit=False)

# predict which currencies will increase

prediction, probability = model.predict(s_train[:, -1])

# trade if probability above threshold

portfolio = probability > threshold

if not portfolio.any():

continue

# position weights proportional to probability of prediction

weights = (prediction * probability)[portfolio]

weights /= np.abs(weights).sum()

weights[weights > max_weight] = max_weight

# take trading positions

position = leverage * account[i,t2] * weights

# calculuate returns and accuracy

account[i, t2] += (position * percent_change[portfolio]).sum()

accuracy[i, t2] = (prediction == realized_s)[portfolio].mean()

t1 += 1

t2 += 1

end = time.time()

print 'backtest time: %.02f minutes' % ((end-start)/60.,)

np.save(account_file, account)

np.save(accuracy_file, accuracy)

backtest time: 10.01 minutes

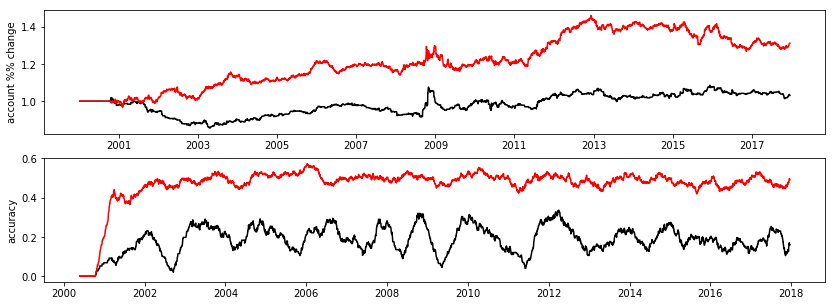

Finally, we examine which model performed better by plotting the account balance and rolling mean of the prediction accuracy. The model with the quadratic term performed better in by return and prediction accuracy.

In [6]:

accuracy_rolling_mean = pd.DataFrame(accuracy.T).rolling(100).mean().values.T

print 'accuracy: model 1: %.02f, model 2: %.02f' % (accuracy[0].mean(), accuracy[1].mean())

fig, ax = plt.subplots(2, 1, figsize=(14, 5))

ax[0].plot_date(dates[1:], account[0], 'k-', label='linear')

ax[0].plot_date(dates[1:], account[1], 'r-', label='quadratic')

ax[1].plot_date(dates[1:], accuracy_rolling_mean[0], 'k-')

ax[1].plot_date(dates[1:], accuracy_rolling_mean[1], 'r-')

ax[0].set_ylabel('account %% change')

ax[1].set_ylabel('accuracy')

plt.show()

accuracy: model 1: 0.18, model 2: 0.47